Let's say you're at the point of collecting final deposit. After all the hard work and planning you put toward your client's vacation, do you really want to set them up with a travel insurance plan that doesn't meet their needs? If you failed to mention time-sensitive benefits at or before initial deposit, you might be doing just that.

Some travel agents find it easy to explain time-sensitive benefits in their pitch, while others are left scrambling for the words to say until they get back to the easy part, selling the travel experience.

What's the secret? As with most things: experience. And if you don't have any, don't worry - there's still hope.

We here at TravelSafe have compiled a couple of tactics you can use to feel at ease when explaining time-sensitive travel insurance benefits to your clients.

The Unsaid: Your Client May Not Tell You About Their Pre-Existing Condition

The appearance of your client and their actual bill of health may not always line up.

Too often we hear of travelers who are headed on a trip and need coverage for their pre-existing medical conditions. The only problem: they are purchasing the policy too late.

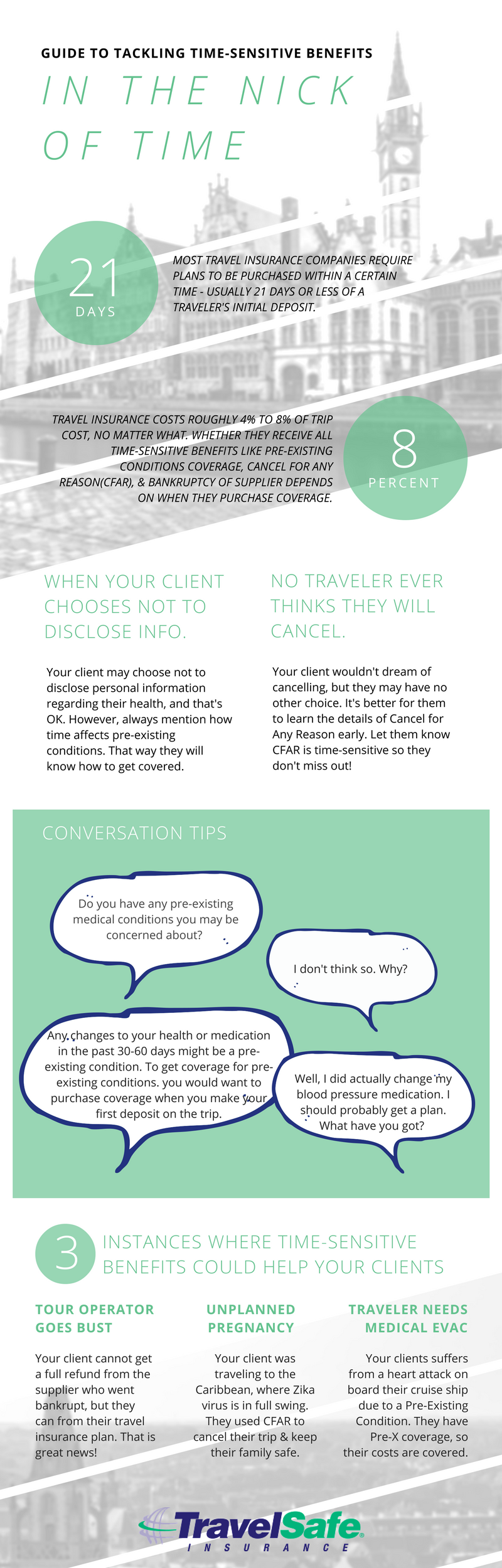

We all know travel agents are not doctors. It is not your job to give your clients a health questionnaire. But there is something agents can do to prevent this from happening to their clients -- they can ask the client if they have any pre-existing conditions when accepting the initial trip deposit.

The dialogue can be as simple as this:

Agent: Do you have any pre-existing medical conditions you may be concerned about?

Traveler: I don't think so. Why?

Agent: Well, if you have seen a doctor or your medication has changed within the last 30-60 days, you may want to consider purchasing travel insurance when you make your first deposit on the trip. This will allow for you to have medical coverage for any pre-existing conditions you may have. In case something happens on your trip.

Traveler : Oh, wow. Okay! Well, I did change my blood pressure medication recently, so maybe I should purchase a policy. What have you got?

That was easy, wasn't it? Not only will you show your clients you know how to plan an amazing trip, you will also show them you are concerned about their overall well-being and help them avoid unnecessary expenses.

The Unknown: Clients Don't Know What the Future Holds, but They Should Know Their Options

It's an unfortunate truth, but there are reasons for cancellation that travel insurance companies cannot cover. It is why many companies implemented a benefit allowing cancellation for any reason. It is why TravelSafe invented it!

The caveat: CFAR benefits are time-sensitive.

In order to be eligible for this benefit, travelers must purchase their policy within a specific timeframe. While this is the case for most, if not all travel insurance companies, many inexperienced agents gloss over this detail. In several instances, this has cost their clients significantly.

Many travelers wait until the final stages of the booking process to purchase their travel insurance policy. Some travelers believe the insurance can wait until they make their final deposit only to find out they are not eligible for Cancel For Any Reason. Advising your clients against this could benefit them a great deal.

This could all be avoided with a quick mention by the travel agent. Experienced and successful travel agents mention Cancel For Any Reason when they give their client the first quote. Then, they mention our 21-day window for CFAR upon collecting the initial trip deposit.

You may be required to take this a step further when your client asks why anyone would purchase CFAR. Clients are usually 100% committed to going when they book a vacation. However, things come up – plans change.

Let's take a look at Zika virus. In a matter of months, it became clear that Zika virus posed threat of microcephaly to newborn babies. That was enough for hundreds of honeymooners and babymooners to cancel their trips.

Do you think they ever thought they'd be cancelling their honeymoons?

To the dismay of many, travel insurance did not cover fear of pandemic or epidemic. If travelers had contracted Zika and were unable to travel, they would have coverage. But without CFAR, cancelling their trip due to the possible threat of contraction was not a possibility.

In one instance, a traveler expressed she had not been told about CFAR at all when booking through her agent. She found out she was pregnant prior to her trip and decided to cancel. Her fears of contracting Zika were not a covered reason under Trip Cancellation. Had she purchased a policy with CFAR, she would have been eligible for reimbursement.

@travelsafeins - any thoughts adjusting your policy? 'Scarier than we initially thought': CDC sounds warning on Zika https://t.co/TBT1Unpahk

— Sara O'Brien (@sjobrien03) April 11, 2016

@TravelSafeIns Travel Agents should learn more about this in order to educate those who purchase the travel insurance through them.

— Sara O'Brien (@sjobrien03) April 12, 2016

@TravelSafeIns Got no information of that sort, only question was do you want insurance 'yes or no', didn't know there was variations.

— Sara O'Brien (@sjobrien03) April 12, 2016

Travel insurance plans contain a lot of information, and we are not interested in making travel agents insurance experts. That is why we are here. However, informing your clients of the time-sensitive provisions and recommending they call us with any questions can save them stress and money.

At the end of the day, the better informed your clients are about their options with travel insurance, the better their decision making ability. Agents who take time to go over key facts such as time-sensitive benefits see less claim denials for their clients.

Not every claim can result in payout. Some are just not legitimate claims. However, the better informed your clients are, the easier it is for them to understand travel insurance and how they are able to benefit from their policies.

Don't just give them a check box. Get their attention, highlight the time-sensitive benefits, and have them call your provider with details on coverage. By doing this, your agency has nothing to lose. By not, you could potentially lose a client or find yourself dusting off your E&O.