Basing your stay off of a country's 5-star hospital rating is something you just don't do. Before travel, most travelers aren't thinking about the costs of medical services abroad. Perhaps that's why travelers often bypass travel insurance. They aren't thinking of the risks.

Falling closely behind Emergency Medical Evacuation is the Medical Expense benefit. At TravelSafe, we consider this the second most vital benefit within our plans.

We have paid claims so high in cost they could have devastated the families who filed them. Before you get travel insurance quotes online, it is good to know more about medical coverage.

What you need to know about travel insurance & medical coverage

What happens if you become ill or injured while traveling? Hopefully, you will have coverage. Those who don't can expect to pay for any medical care out of pocket.

What is travel medical insurance?

Simply put, it is coverage for medical expenses gained while traveling. The medical expenses must be ordered by a doctor who is legally qualified, and the expenses must be medically necessary for diagnosis or treatment.

Travel medical insurance can be a single plan or a benefit within a comprehensive plan. TravelSafe's Basic, Classic & Classic Plus plans treat medical coverage as a benefit within their plans.

How does it work?

In most cases, travel insurance provides reimbursement for medical expenses incurred. You would need to provide receipts, hospital bills, and any admission paperwork to the insurance company. If you met the requirements with no exclusions like a pre-existing condition, you would be reimbursed up to your benefit limit.

When does medical coverage start?

It begins on 12:01 a.m. on your scheduled departure date. Pretty simple, right?

When does coverage end?

Coverage ends at the point and time of your scheduled return. However, there are exceptions.

For example, if your return is delayed by airline or tour operator, your coverage can be extended for those dates with proof or documentation.

If you become ill or injured while traveling and must be hospitalized, your travel insurance will extend until the date of discharge. However, your coverage will end if you are medically evacuated to a hospital close to home.

Do foreign countries require travel insurance?

It depends. There are some countries that require you to have, at the very least, medical insurance coverage upon entry.

Those countries are:

- Cuba

- Qatar

- The United Arab Emirates

- Turkey

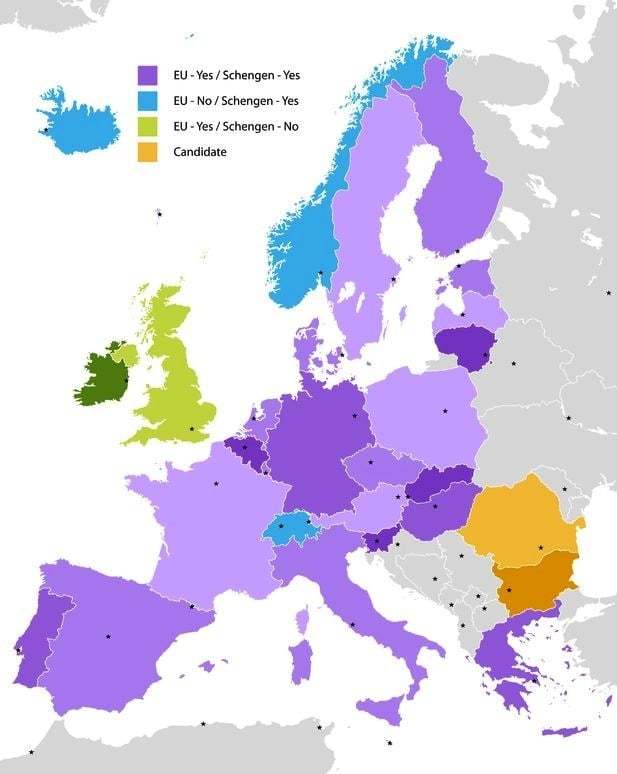

This map shows the Schengen Countries. Since the map's creation, the United Kingdom has voted to leave the European Union.

However, medical coverage is sometimes a visa requirement. Some countries, like the Schengen Countries, require citizens of the U.S. and Canada to have a visa for stays longer than 90 days but not for stays below 90 days.

For stays longer than 90 days, you are required to have medical coverage of at least €37,500. Even though you won't be legally required to have insurance for non-visa stays that doesn't mean you should travel without it.

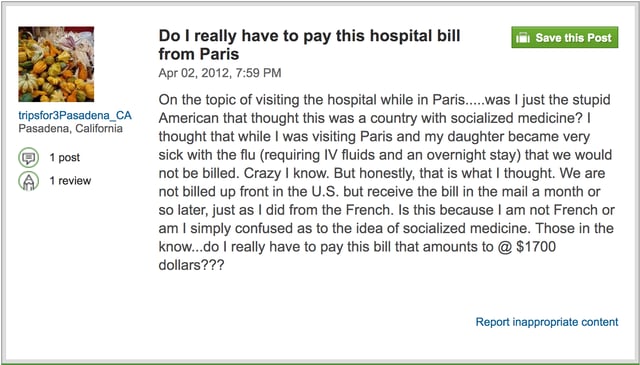

Health care may be socialized in Europe, but that does not mean all world citizens are able to receive free medical care. Below is a story from a traveler from Trip Advisor who thought they weren't responsible for the medical bill.

Yikes — not fun to receive a bill on a vacation you're probably still paying off. Best get travel insurance next time. As some of Trip Advisor's best put it:

And then ...

What are some examples of covered medical costs?

What are some examples of covered medical costs?

We get a lot of questions regarding what is and isn't covered. It's always good to highlight a few instances where you'll be eligible for coverage.

Here are some examples of things we do cover:

- Injury sustained during a terrorist attack

- Scuba diving up to 30 ft depths

- You were mugged, somehow your nose was broken during the attack, and you need medical care. We're so sorry! Let us cover the medical expenses for that broken nose.

- There you were, minding your own business, basking in the beauty of Old Faithful Geyser when a bison knocked you off of your feet. That broken tailbone is going to need medical care. The good news? We've got you.

- Third-degree sunburn. Wear sunscreen, kids — this happens more often than you'd think.

Are there exclusions?

Each insurance company has a list of exclusions within each policy. These conditions are policy wide, but it is important to know how they pertain to your medical coverage.

Photo of four base jumpers in Yosemite. Base jumping is not a covered sport in TravelSafe plans.

Here is a list of items TravelSafe does not provide coverage for:

- Pre-existing conditions without the Pre-existing condition waiver

- Suicide, attempted suicide, or any intentionally self-inflicted injury

- War, or an act of war

- Participation in a riot

- Service in the armed forces

- Mental or nervous disorders

- Treatment in connection with alcoholism and drug addiction

- Expenses as a result of any felony or attempt to commit a felony

- Pregnancy

- Skydiving

- Hang gliding

- Parachuting

- Races

- Bungee jumping

- Spelunking or caving

- Extreme skiing

- Mountaineering

The average American wouldn't participate in a riot, and if you're interested in extreme sports, then you would most likely know you have to search for unique travel insurance coverage that is more tailored to your needs.

What are pre-existing conditions?

A pre-existing condition is basically an illness, disease or injury you have received or been recommended to receive any medical attention for.This dates 60 days prior to the first day you or a traveling companion placed a deposit on your trip.

Read a full article on pre-existing conditions here.

What if the hospital needs payment up front?

We've seen it before — a traveler seeks medical treatment for an accident only to be told they must pay for the services up front. Some countries require payment prior to medical treatment, and this can burden the traveler, their traveling companions, and family.

A good travel insurance plan will have medical assistance built into their policy. Medical assistance will often include deposits, advances, and guarantees. Guarantees will provide a promise to pay for necessary medical treatment.

This takes the burden off of the traveler allowing them to focus on their number priority, their health.

How do I know I am receiving proper medical care while traveling?

If you have ever traveled to a developing country, you may be aware of how different medical care is compared to that of the U.S., but no matter what country you are in, it is still a different environment. Gauging the quality of care can be difficult.

TravelSafe saw this as an issue. One of the many benefits to partnering with On Call was solving the problem. Now, On Call's Emergency Assistance can help travelers feel like they are receiving the best treatment possible while abroad.

How? By confirming the hospital is up to their U.S. standards. If it isn't, they'll transfer to the closest hospital that is.

Having medical coverage while may not always be necessary but it's always a smart choice. The chances of needing care may be slim, but what you will pay without coverage can be crippling.

Don't forget to read your state specific certificate for coverage details. As always, travel safe!