You've planned a really amazing vacation for yourself. Your overall itinerary is put together as if a travel professional designed it – and maybe they did. And thanks to hours spent on travel blogs, forums, and Trip Advisor, you're feeling pretty good about your trip.

So why is it that you have decided not to buy vacation insurance?

We hear about issues that come up in travel every day. Unfortunately, many travelers forgo travel protection, often putting themselves in a pinch.

There are many opportunities to buy travel protection. If you're having trouble seeing its worth, consider whether you're making any of the following mistakes to keep you from getting the right plan for your trip.

1. You Think Your Health Insurance Goes Abroad

Many people think their health insurance covers them abroad, only to find out the hard way that it doesn't.

As we highlighted in a previous post about medical coverage and travel insurance, your health insurance does not always cover you overseas, and countries with socialized medicine only extend that right to their citizens.

In fact, many privatized hospitals in foreign countries will expect some form of payment up front. Your health insurance company will not promise to pay, and you'll potentially be stuck maxing out your credit cards for a 5 figure deposit.

We spoke to Jessica Walb, Health & Life Insurance Agent of Chester Perfetto Agency, Inc. who says, "It is important to check with your health insurance provider before you leave the country. Chances are, you're not covered. Even if you are, your coverage will be nothing like it is at home. I always tell my clients to get travel insurance."

"This is especially true for those with medicare/medicaid," Jessica says. "As soon as the cruise ship departs, you are out of the country. That means your medicare won't be going with you, unless you get a supplement.

But even those with a supplement can find themselves in a bind. "Even with a Medicare Supplement, you will only have 80% of your costs covered up to $250,000. That won't include a medical evacuation."

2. You Won't Cancel Your Trip, Right?

Cancellation happens. We see it all of the time. No one thinks they'll have a bad breakup before the honeymoon, or realize they can't travel to South America now that you and your partner are expecting – Zika virus anyone? In fact, many first-time buyers of trip protection have experienced a cancellation that made them think, "I am never traveling without insurance again."

Trip cancellation can happen to anyone. You can't control the weather anymore than you can control the death of a family member. It is best to have coverage for your trip in the event the unthinkable happens.

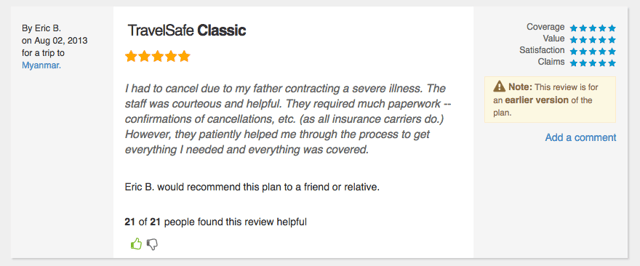

Take one traveler, Eric, whose father became gravely ill. He was able to cancel his trip, have coverage, and be there for his father. Had this been a member of his extended family – aunt, uncle, or step-sibling – coverage could have been applied as well.

Image by Insuremytrip.com, an authorized retailer of TravelSafe.

Image by Insuremytrip.com, an authorized retailer of TravelSafe.

3. You Think You're Covered By Your Credit Card

When your credit card company advertises the great travel protection they offer, they often leave out a few caveats: the protection they offer is often limited and packed with exclusions.

While you may see coverage for Trip Cancellation, Interruption, and AD&D, the limits are often fairly low. We recently looked at the Chase Ink Preferred Review by Nerd Wallet and found seriously low benefit limits.

Chase's card offers Trip Cancellation and Interruption up to $5,000 and a Travel Delay benefit with a maximum of $500 per ticket purchased. Chances are, in order to receive these benefits, cardholders would have to purchase the full trip on the card.

With a third party insurer like TravelSafe, your Trip Cancellation and Interruption benefits are much higher. And to top it all off, you receive benefits like Medical Expense and Emergency Evacuation. Benefits no credit card company insures.

4. You Suffer From Optimism Bias

We have all been guilty of this. We go into an experience thinking the worst case scenario just couldn't happen to us. We are too smart, too prepared, and generally very lucky. That is, until we're not.

According to Wikipedia, optimism bias (also known as unrealistic or comparative optimism) is a cognitive bias that causes a person to believe that they are less at risk of experiencing a negative event compared to others. The optimism bias is quite common and transcends gender, race, nationality and age.

Next time you see a travel horror story, forget the optimist's tropes and think of this: one in every six travelers has their trip impacted by something out of their control. According to US Travel Insurance Association, 1 in 6 travelers experienced the following:

- Medical conditions such as illness or injury

- Severe weather like storms, hurricanes and blizzards

- Delays of 3 or more hours due to mechanical and other problems experienced by an airline or cruise line.

5. You Think Your Supplier Coverage Will Do

It is true, travel suppliers offer a form of travel protection, but do not be fooled. This is not the same thing as third party travel insurance.

Travelers will often receive credit to rebook their trip at a more convenient time. This doesn't hold a candle to receiving monetary benefits like they would with a trip insurance provider. That is why it is important to know the difference between supplier protection and a third party provider.

Read about the different between third party travel insurance and supplier protection here.

6. You Aren't Sure Where to Start

Let's face it. People are busy. So busy, in fact, that making time to understand another insurance plan can seem overwhelming. You may not know where to start, which is why credit card coverage sounds appealing. It's better than nothing right?

Instead of taking a plan with minimum coverage, opt to check out a travel insurer's comparison. Almost all vacation providers comparison pages that easily highlight coverage.

Check out TravelSafe's Plan Comparison here.

When you are able to compare benefits, it gives you an idea of the industry standard. It also highlights just how much coverage you can get.